Financial market insights

Mexico: a challenging yet high-potential landscape for fintech innovation

As the global financial landscape evolves, Mexico stands out as a pivotal player, especially in the realm of Buy Now, Pay Later (BNPL) services. However, penetrating the Mexican market proves uniquely challenging for foreign companies venturing into consumer financial services. This article delves into the intricacies of entering Mexico's financial services sector, shedding light on the hurdles faced by international players.

January 24, 2024 · Reading time 2 min

The Mexican Market

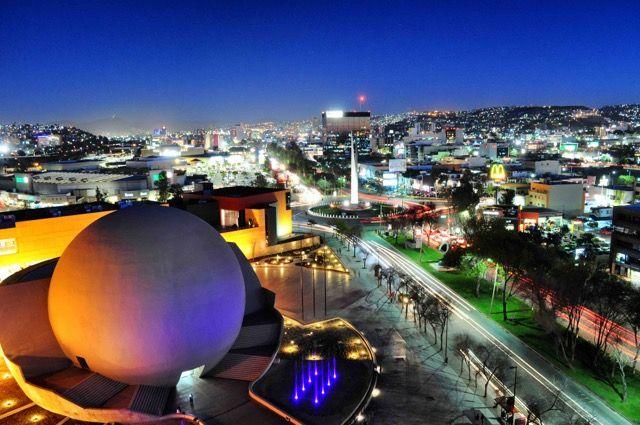

Mexico, with its substantial population of underbanked individuals, presents a promising market for financial services companies. The potential for growth is significant as the country actively seeks to enhance financial inclusion. Nevertheless, beneath the surface lies a complex environment that demands a nuanced approach, particularly for companies offering innovative solutions like BNPL.

Challenges for Foreign Companies

For foreign companies eyeing Mexico, the challenges are manifold. Whether entering the BNPL space, providing loans, or exploring other fintech realms, navigating the regulatory landscape and understanding local nuances are paramount. The Mexican market, characterized by stringent regulations and unique consumer behaviors, necessitates a thorough understanding for success.

Data and Insights

Recent data underscores the substantial barriers to entry for foreign financial service providers in Mexico. Regulatory hurdles, local competition, and the need for tailored products that resonate with Mexican consumers all contribute to the complexity. The underbanked population, while presenting an opportunity, requires a careful approach to address the diverse financial needs of the market.

Conclusion

Mexico holds immense potential for companies in the financial services sector, with a notable transformation from underbanked to banked individuals. The underbanked population signals a shift towards better financial inclusivity, making it an attractive prospect. However, a cautious and informed approach is vital. This dynamic landscape encourages Fintech innovation, exemplifying the need for adaptability and commitment to meeting the unique needs of the local population.

Creditea's credit underwriting processes, backed by International Personal Finance's successful decade-long operation in Mexico with a customer base of 800,000, showcase a robust foundation. The recent introduction of Creditea represents a pioneering BNPL initiative, set to deliver a unique proposition to Mexican consumers and merchants. This move not only fosters the adoption of cutting-edge Fintech solutions but also empowers consumers with the convenience of credit-based payments.